Guidelines on Import of the different Cargos in Bangladesh

There are 37 Types Import cargoes for which the ‘Bangladesh Customs Authority’ entitles the

consignee to take the delivery of the cargo from the Custom Bonded ‘Private Inland Container

Depots’ (Private Off-Docks) in Bangladesh upon the completion of the Customs Formalities.

These commodities are widely known as the ‘Depot Delivery Items’. These 37 Types of

commodities are as follows

| Type |

Item |

Details |

| Animal Fodder (Animal Feed) |

Rice |

Distiller's Dried Grains with Solubles (DDGS) [H. S. CODE: 2308.00.00] |

| Ball clays (in Bulk) |

Metal Scrap |

Garlic (Dry Container) |

| Bitumen |

Soda Ash |

Ginger (Dry Container) |

| Carbon Black |

Sodium Sulphate |

Onion (Dry Container) |

| Chickpeas (Chola) |

Staple Fiber |

Rape or Colza Seed Extraction [H. S. Code: 2306.49.00] |

| Dates |

Sugar |

Palm Nuts (Palm Kernels) [H. S. Code: 2306.60.00] |

| Fertilizer |

Waste Paper |

Soyabean Meal (Soyabean Extraction) [H. S. Code: 2304.00.00] |

| Global Salt |

Wheat |

Corn Gluten Meal [H. S. Code: 2302.10.00] |

| Hard Coke |

Wood Pulp |

Soya Beans [H. S. Code: 1201.90.90] |

| Marble Chips |

Carbon Block |

Polyvinylchloride (PVC Resin) |

| Marble Stone |

|

Rice Bran [H. S. Code: 2302.40.00] |

| Mustard Seed |

|

Maize [H. S. Code: 1005.90.90] |

| Lentils or Pulse (Daal) |

|

Empty Can of Beverages |

| Raw Cotton |

|

Containerized Square or Round Log |

Cargoes, such as Dangerous Goods (Hazardous Cargoes), Firearms and Ammunitions including Sport Guns,

Air Pistols, any kind of Explosive Items, Tear Gas Canisters, Currency and Currency paper,

Non-Judicial Stamps, Security Printing Paper, and Ink, Banknote Paper, Cheque Printing Paper,

Passports, any cargo for Army, Cars Knocked Down (CKD) Goods, Cement, Fertilizer, Rapeseeds, Loose

Scrap, Corrugated Iron sheet Sheets, Galvanized Plain Sheet, Black Phosphorus Sheets, Tin Plates or

similar type of Iron Material, Alcohol, and Alcoholic Beverage can be imported through proper

consultation with the carriers.

Bank Notes, Security Papers, Printing Ink for Currency are not acceptable as 'CFS' Status and must

be on 'CY' status. Thus prior intimation must be given to the Destination Office/Agent Office of the

carriers at least 72 hours before the arrival of the vessel to any Bangladeshi Port to arrange

appropriate security as well as to obtain necessary documents to facilitate Import Discharge/Landing

permission and secure smooth cargo delivery to the consignee.

Import of Dangerous Goods (Hazardous Cargoes) in any Reefer Containers is strictly prohibited.

Cargo in Reefer Containers of 220 Volts are not allowed to be imported in Bangladesh since there are

strict restrictions by the 'Chittagong Port Authority' (CPA) due to the non-availability of the

Plug-In Facility at Chittagong Port. Only the Reefer Containers of 440 Volts is allowed.

Cargoes, such as ‘Calcium Carbide’, ‘Sulphur’, ‘Refrigerant Gas’, ‘Tetrafluoroethene’, ‘Liquefied

Gas’, ‘Isobutane’, ‘Fish Meal’, ‘Fish Feed’ and ‘Chlorodifluoromethane’, etc. are not acceptable to

Import in Bangladesh unless approved by ‘Bangladesh Naval Authority’. The carriers can accept such

cargo after getting confirmation from the shippers or Consignees upon submitting the below-listed

documents in Original at the Destination Office/Agent Office of the carrier 72 hours before the

vessel's arrival. Otherwise, the ‘Bangladesh Naval Authority’ does not allow containers discharging

from the Vessel (Discharge Held-Over).

- Bill of Lading (BL)

- Invoice of the Cargo

- Packing List of the Cargo

- Goods Analysis Certificate ("The goods are free from Chloramphenicol and Nitro-furan", must have

been written on the Report of Analysis)

- Radiation Certificate

- Veterinary Certificate

- Fumigation Certificate (Pest-control Certificate)

- Authorization certificate from the 'Chief Controller of Imports and Exports, The Ministry of

Commerce, Government of the People's Republic of Bangladesh'.

- Department of Explosives, The Ministry of Power, Energy and Mineral Resources, Government of the

People's Republic of Bangladesh.

- Storage and user license from 'Bangladesh Customs Authority'.

Commodity Restriction – At a Glance

| Service Points |

Acceptance |

Notes |

| Personnel Effect |

Not Acceptable |

- Exceptions applicable for Embassies, High Commissions, and Organizations

of

the United Nations (UN)

|

| Reefer |

Acceptable |

- Reefer Containers of 220 Volts are not acceptable due

to the non-availability of the facility inside Chittagong Port.

- Reefer Containers of 440 Volts are acceptable.

|

| Food Item |

Acceptable |

- A Radioactivity Test Report is required from the

concerned authority of the origin country for food items (Import

Policy Order, 2015-2018 Para 16).

- A Clearance Certificate from the 'Bangladesh Atomic

Energy Commission' is required for food items, certifying that the

radioactivity level found in the imported food is within the acceptable

limit.

- Imported Animals, Plants, and Plant Products must be observed under

Quarantine Conditions (certifications required from the

Veterinary Department, Quarantine Department, and Fumigation

authorities).

|

| Animal, Plant, and Plant Products |

Acceptable |

- A Pre-shipment Inspection Test Report is required for:

- Milk Food Products

- Powder Milk

- Coal and Hard Coke

- Break Acrylic (HS 39.15 and 3915.90)

- M.S. Billets (HS 7207)

- Any item where the value of a single authorized import by

Government

Agencies is BDT 5,000,000 (Fifty Lacs) or

above.

|

| Dangerous Goods (Hazardous Cargoes) |

Acceptable |

- Discharging/Landing Permission must be obtained from

the 'Bangladesh Navy Authority' due to naval installations inside the

Port near Terminals (Berths).

- Declaration of the respective IMO

Class and UN Number must be mentioned in

the cargo manifest.

- Bill of Lading (BL) must include:

- Emergency Telephone Number

- Fax Number

- Email IDs of the Consignee/Notify Party

- Dangerous Goods under IMO Class 1 and 7 are allowed for

discharge/landing under Direct Delivery (On-Chassis

Delivery) with prior permission from the 'Bangladesh Naval

Authority'. The consignee must be prepared for Direct Delivery as the

'Chittagong Port Authority (CPA)' will not provide storage space in

Transit Sheds.

- Dangerous Goods under IMO Class 2, 3, 4, 5, 6, and 8

are allowed for discharge/landing with prior permission from the

'Bangladesh Naval Authority'.

- The following items are treated as Dangerous Goods (Hazardous

Cargoes) in Bangladesh:

- Beer (IMO Class: 3, UN No.: 1170)

- Assorted Whisky (IMO Class: 3.3, UN No.: 3065)

- Raw Cotton (IMO Class: 4.1, UN No.: 1999)

|

Declaration of ‘Proper Shipping Name’ (PSN) with specific ‘Harmonized

System’ (HS) Code in ‘Bill of Lading’ (BL) and Import General Manifest (IGM)

For importing any cargo in Bangladesh, the ‘Chittagong Port Authority’ (CPA) accentuates the

depiction of the Proper Shipping Name (PSN) coupled with the specific ‘Harmonized System’ (HS) Code

of the cargo in the cargo description segment of the Bill of Lading (BL) as well as in the ‘Import

General Manifest’ (IGM). The idea is to ensure the detection of the ‘Dangerous Goods’ (DG) and

maintain strict Safety compliance. If any Import Shipment which doesn’t reflect specific details of

the cargo, the container is ‘Retained on Board’ (ROB) by the ‘Chittagong Port Authority’ (CPA) for

further verification of the relevant shipping documents to be confirmed about the cargo loaded in

the container.

The following are the short-listed cargo details that the ‘Chittagong Port Authority’ (CPA)

considers vague

- Assorted Goods

- Building Material & LED Lamp With Fitting

- Building Materials

- CCTV Equipment

- Electric Parts

- Electronics Components and Spare Parts

- Electronics Spare Parts

- Fire Equipment

- Fire Extinguisher

- Fire Fighting Equipment

- Footwear Materials and Accessories

- LED Bulb Parts

- LED Bulb**

- LED Lamp**

- Materials for Bags

- Materials for Footwear

- Mobile Accessories

- Mobile Parts

- Office Accessories

- Office Equipment & Materials for Bags

- Packing Materials for Footwear

- Parts and Accessories of Bicycle

- Parts of LED Bulb & Other Parts

- Raw Materials

- Shoe Materials

- Spare Parts for Three-Wheeler Motorcycle Parts

- Textile

Notes:

** Description for these cargoes must confirm whether the cargo includes/contains any Battery

or not.

Using ‘Bullet Seal’ for ‘Import Laden Container’ to Bangladesh is mandatory

According to the ‘Chittagong Port Authority’ (CPA) Circular No.: 17/2021, Dated 27TH October 2021,

issued by, it has been advised by the ‘Chittagong Port Authority’ (CPA) that, using plastic or

metallic seals is strictly prohibited and using ‘Bullet Seal’ for all import laden containers to be

handled through the Port of Chittagong is mandatory. The ‘Chittagong Port Authority’ (CPA) has also

specified that if any import-laden containers are found without a ‘Bullet Seal’ affixed, the

discharging of that container will not be allowed.

The customers are humbly requested to comply with the instructions delineated by the ‘Chittagong

Port Authority’ (CPA) as per the circular and mandatorily affix ‘Bullet Seal’ for the import-laden

containers.

Advance ‘Import General Manifest’ (IGM) submission in Bangladesh Custom-led ‘ASYCUDA World’

From 01ST July 2019, The ‘Bangladesh Customs Authority’ has opted for the Advance ‘Import General

Manifestation’ which frames that the deadline for ‘Import General Manifest’ submission in ‘ASYCUDA

World’ (w,e,f. 1ST September 2013) within 24 hours prior to the sailing of the Vessel from the last

Port, before calling any Bangladeshi Port to 48 hours before arrival of the vessel at any

Bangladeshi Port [as per Feeder Operator’s ETA declaration to Port/Bangladesh Customs (not as per

Proforma Schedule or ETB)].

At present, the Freight Forwarders are licensed and submit ‘Import General Manifest’ to in ‘ASYCUDA

World’ before 24 hours of the arrival of the Feeder Vessel at any Bangladeshi Port and supplementary

‘Import General Manifest’ is declared by their name as Consignee. consequently, Freight Forwarders

are liable for any discrepancy of the cargo related information in the ‘Import General Manifest’

(e.g.: Short/Excess/Mis-declaration/Wrong Mark/Nil mark/Weight etc.).

The carriers' POL Office/Agent Office have to ensure that all Freight Forwarders appear as

Consignee/Notify Party on the respective part on the body of the 'Bill of Lading' (BL) as per the

specfic enlistment details for the Freight Forwarders in Bangladesh Customs site

(www.customs.gov.bd) with valid ‘Agent's Identification Number’ (AIN).

Documentation Requirements for Import in Bangladesh

The following are the key Documentation requirements for Import in Bangladesh and for ‘Import

General Manifest’ (IGM) submission in Bangladesh Custom-led ‘ASYCUDA World

Shippers’ Details

-

The body of the 'Bill of Lading' (BL) must contain valid shippers’ name with proper address

in the

respective fields.

Consignee's Details

- In the case of a Bank consigned 'Bill of Lading' (BL), the name of the respective

Bangladeshi Bank and its proper address coupled with its valid ‘Business Identification

Number’ (BIN) or ‘VAT Identification Number’ (VAT Registration Number) must be depicted in

the respective field of the respective 'Bill of Lading' (BL).

- If the consignee is a Direct Customer and there is no Bank involved, then the respective

'Bill of Lading' (BL) must contain the Bangladeshi Consignee’s/Importer’s Name and proper

address coupled with the valid ‘Business Identification Number’ (BIN) or ‘VAT Identification

Number’ (VAT Registration Number) in the respective field.

- If the consignee is a local Freight Forwarder, then the respective 'Bill of Lading' (BL)

must contain the Government Approved name of that Freight Forwarder and proper address

coupled with its valid ‘Agent's Identification Number’ (AIN).

- The name of any Foreign Party, Foreign bank, or foreign address is not allowable as

Consignee.

- Only ‘To Order’ or ‘To the Order of Shipper’ is not allowable as Consignee.

- The Consignee as the Direct Customer or Importer, but the Notify Party as a local Freight

Forwarder or Freight Forwarder’s Agent is not allowed.

- ‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT Registration

Number) should contain 11 digits.

- ‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT Registration

Number) that starts with ‘0’ or any alphanumeric characters is not allowed.

Notify Party’s Details

- If the Notify Party is a Direct Customer, then the 'Bill of Lading' (BL) must contain the

Bangladeshi Notify Party’s/Importer’s Name and proper address coupled with the valid

‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT Registration

Number) in the respective field.

- If the Notify Party is a Local Freight Forwarder, then the respective 'Bill of Lading' (BL)

must contain the Government Approved name of that Freight Forwarder and proper address

coupled with its valid ‘Agent's Identification Number’ (AIN).

- The name of any Foreign Party or foreign address is not allowable as Notify Party.

- Local Bank as the 1st Notify Party is not allowed.

- Notify Party as ‘Same as Consignee’ is usually not allowed, and the Consignee Details must

be mentioned in the Notify field. However, if the cargo is under a ‘Sales Contract’ or a

‘Telegraphic Transfer Contract’ (TT), then the Consignee can be declared as the Notify

Party.

- Notify Party as Direct Customer/Importer, but Consignee as a local Freight Forwarder or

Freight Forwarder’s Agent is not allowed.

- ‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT Registration

Number) should contain 11 digits.

- ‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT Registration

Number) that starts with ‘0’ or any alphanumeric characters is not allowed.

Cargo Description

- For smooth and faster documentation purposes, the 'Bill of Lading' (BL) must be updated with

accurate and actual commodity details with a specific ‘Harmonized System’ (HS) Code in the

cargo descriptions.

- If a commodity falls under any kind of Chemical or Raw Materials, it should be mentioned

with the proper Technical Name of the Chemical or Raw Materials in the cargo description

body of the 'Bill of Lading' (BL).

- For proper documentation of any Dangerous Goods (Hazardous Cargo), the respective IMO

Classification, UN Number, and Technical Name of the Dangerous Goods (Hazardous Cargo) must

be mentioned in the cargo description body of the 'Bill of Lading' (BL). The consignee must

submit any Dangerous Goods (Hazardous Cargo) related documents to the carrier’s Destination

Office/Agent Office at least 72 hours prior to the vessel's arrival.

- The ‘Bangladesh Customs Authority’ and the ‘Chittagong Port Authority’ (CPA) will not allow

the discharge of any cargo with an incomplete or unclear commodity name in the commodity

description body of the 'Bill of Lading' (BL).

Kind of Package Type

- The specific, valid, and standard kind of package type must be mentioned in the respective

body of the 'Bill of Lading' (BL)

Cargo Gross Weight

- Cargo Gross Weight must be mentioned accurately in the respective body of the 'Bill of

Lading' (BL), which must be matched with the Packing List and Physical Stuffing Report of

the Cargo. Any incompliance in depicting the Cargo Gross Weight in the respective body of

the 'Bill of Lading' (BL) will be framed as a Violation of Customs Licensing rules and

regulations.

Volume of the Cargo in Cubic Meter (CBM)

- The volume of the Cargo in the Cubic Meter (CBM) must be mentioned accurately in the

respective body of the 'Bill of Lading' (BL), which must be matched with the Packing List

and Physical Stuffing Report of the Cargo. Any incompliance in depicting the Cargo Gross

Weight in the respective body of the 'Bill of Lading' (BL) will be framed as a Violation of

Customs Licensing rules and regulations.

Bullet Seal Number

- The ‘Bill of Lading’ (BL) must be issued with the valid and physically inspected Bullet Seal

Number used in the respective container. Repetition of the seal number will not be

allowable.

Guidelines on Weight Acceptance of the ‘Import Laden Container’ according to Different Ports in

Bangladesh

For General Purpose Container (Dry and Reefer)

| Container Size |

Maximum Permissible Container Weight (including Tare Weight) |

Chittagong Port |

ICD, Kamalapur, Dhaka |

ICT, Pangaon, Dhaka |

Mongla Port |

| 20' DRY |

24,000.00 Kg (24.00 Ton) |

Applicable |

Applicable |

Applicable |

Applicable |

| 40' DRY |

30,400.00 Kg (30.48 Ton) |

Applicable |

Applicable |

Applicable |

Applicable |

| 40' HC DRY |

30,400.00 Kg (30.48 Ton) |

Applicable |

Applicable |

Applicable |

Applicable |

| 45' HC DRY |

30,400.00 Kg (30.48 Ton) |

Applicable |

No Service ** |

No Service ** |

Applicable |

| 20' REEFER |

24,000.00 Kg (24.00 Ton) |

Applicable |

No Service ** |

No Service ** |

Applicable |

| 40' HC REEFER |

30,400.00 Kg (30.48 Ton) |

Applicable |

No Service ** |

No Service ** |

Applicable |

At a glance, the Weight limitations for Import Cargo in Bangladesh are as follows

- The Maximum Permissible Gross Weight (including the cargo weight coupled with the

container tare weight) for the 20' is 24,000 Kg (24.00 Ton), and

- The Maximum Permissible Gross Weight (including the cargo weight coupled with the

container tare weight) for the 40' & 45' is 30,400 Kg (30.48 Ton).

- The Maximum Permissible Gross Weight for per LCL package is 3,000 Kg (3 Ton).

For 'Out of Gauge' (OOG) Cargo, the customers need to check the cargo acceptability with the

respective carriers sharing the below delineated information

- Over-Length, Over-Width, and Over-Height of the Cargo in Centimeter

- Description of the Cargo

- Picture of the Cargo from different angles

- Gross Weight details of the Cargo for checking Weight Acceptance.

- Verified Gross Mass (VGM) as per customer

After the acceptance of the 'Out of Gauge' (OOG) Cargo, the Origins have to share the below

documents:

- Lashing Survey Reports

- Verified Gross Mass (VGM) Certificate

Notes

- Reefer Container, 'Out of Gauge' (OOG) Cargo and 45' HC DRY containers are not acceptable

for

delivery at the ‘ICD, Kamalapur, Dhaka’ and the ‘ICT, Pangaon, Dhaka’

-

Reefer Container is not acceptable for CFS delivery

-

Dangerous Goods (DG) can be Imported in Bangladesh through 20' DRY, 40' DRY, and 40' HC DRY

containers only

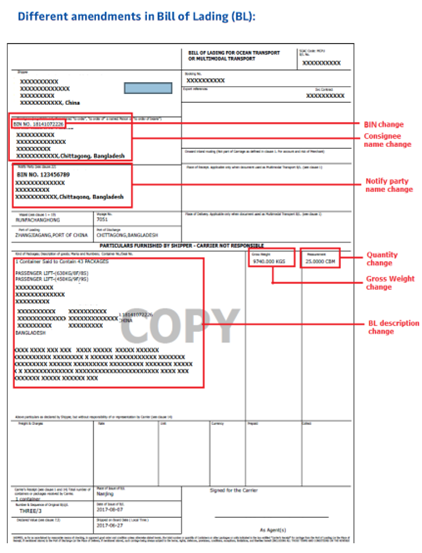

Guideline on the Amendment of ‘Bill of Lading’ (BL) after the submission of the ‘Import General

Manifest’ (IGM)

In Bangladesh, from the below purview, the customers can request for bringing the required

Amendments in the Bill of Lading (BL) even after the submission of the ‘Import General Manifest’

(IGM):

- If there is a Wrong Notify Party, Wrong Cargo Description, Wrong Quantity, Wrong Weight

mentioned in the ‘Bill of Lading’ (BL)

- If the ‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT

Registration

Number) / ‘Agent's Identification Number’ (AIN) of the Consignee/Notify Party is not

mentioned

in the ‘Bill of Lading’ (BL)

- If the ‘Business Identification Number’ (BIN) or ‘VAT Identification Number’ (VAT

Registration

Number) / ‘Agent's Identification Number’ (AIN) mentioned in the ‘Bill of Lading’ (BL) is

incorrect

- If the Unregistered ‘Business Identification Number’ (BIN) in the 'National Board of

Revenue,

Bangladesh' (NBR) [NULL Consignee/Notify Party detail in ASYCUDA World System]

- If the customers need to bring Changes in Consignee/Bank Name mentioned in the ‘Bill of

Lading’

(BL)

After the submission of the 'Import General Manifest', the customers need to follow the

below-delineated procedure for bringing any kind of amendments in the 'Bill of Lading' (BL)

- The customers have to inform the Destination Office/Agent Office of the Carrier regarding

what wrong details should be amended and what should be the correct details through proper

communication.

- A full Set (3/3) of the Original 'Bill of Lading' (BL) must be returned at the Origin

Office/Agent Office of the Carrier or the Destination Office/Agent Office of the Carrier, if

the 'Bill of Lading' (BL) needs to be revised. The photocopy of the following documents

should be supported if applicable:

- A copy of the Original Commercial Invoice

- A copy of the Original Packing list

- Letter of Credit (LC) and Letter of Credit Advising (LCA) (If the consignee is a

Bank)

- VAT certificate [for ‘Business Identification Number’ (BIN) or ‘VAT Identification

Number’ (VAT Registration Number) amendments only]

- No Objection Certificate (from LC opening Bank)

- No Objection Certificate (from the wrong Consignee/Notify party [as applicable])

- The Destination Office/Agent Office of the Carrier will send the request of the customer to

the Origin Office/Agent Office of the Carrier to attain ‘Approval’ and ‘No Objection’ from

the respective Shipper before processing any 'Bill of Lading' (BL) amendment request.

- The respective Shipper needs to agree with the changes and should share consent for

processing the amendment with the Origin Office/Agent Office of the Carrier, which will

further be shared with the Destination Office/Agent Office of the Carrier.

- A new set of 'Bill of Lading' (BL) will be issued based on the respective Customer's

requirement either at the Origin or at the destination, if necessary.

- The requested amendment can only be initiated, once the new set of 'Bill of Lading' (BL) [if

necessary] is endorsed by relevant and involved concerns (Such as - Bank, Importer, Custom

House Agent).

- The Consignee also needs to submit a photocopy of a properly endorsed new set of 'Bill of

Lading' (BL) [if necessary] to the Destination Office/Agent Office of the Carrier.

After the issuance of a new set of 'Bill of Lading' (BL) [if necessary], the Destination

Office/Agent Office of the carrier will issue an ‘Amendment Request Letter’ addressing to the

respective Customs Authority on behalf of the consignee and next will hand it over to the

respective Consignee or to the nominated 'Custom House Agent' of the consignee further to

proceed for obtaining approval from the respective Custom Authority.

Any kind of amendment will only be completed upon getting approval from the respective Custom

Authority. Once the required and requested amendment is approved by the respective Custom

Authority, the respective consignee should confirm the same to the respective Destination

Office/Agent Office of the Carrier as well as share a copy of the approval.

The destination Office/Agent Office of the carrier will charge the below costing to the

respective consignee

- Penalty Amount charged by the respective Custom Authority for the required and requested

amendment.

- ‘Bill of Lading’ (BL) Amendment Fee (as per rules of the carrier).

- New set of ‘Bill of Lading’ (BL) Issuance Fee (as per rules of the carrier).

Notes

- 'Agent's Identification Number' (AIN) is applicable for Freight Forwarders.

-

'Business Identification Number' (BIN) also known as VAT Registration Number is applicable

for Banks and Importers.

Guidelines on the Service Modes and Freight Collect Acceptance in terms of Import

Interpretation of the different Service Modes by the ‘Bangladesh Customs Authority’:

| Service Mode |

Considered as per Local Interpretation |

| CY-CY |

FCL |

| CFS-CY |

FCL |

| CY-CFS |

LCL |

| CFS-CFS |

LCL |

FCL/Part

When there more than one consignment loaded in a single container and all the

consignments are consigned to same consignee, manifest have to be submitted as CY-CY (FCL).

Meanwhile, since the container is available under more than one 'Bill of Lading' (BL), the

'Import General Manifest' must be submitted as ‘PART’ for the container under all the 'Bill of

Ladings' (BLs). This service Mode is termed as 'FCL/PART'.

FCL/PART is only acceptable for the factories under Export Processing Zones (EPZs).

Acceptability of different Service Modes

| Number of Container |

Number of BL/Consignment |

Number of Shipper |

Number of Consignee |

CY-CY |

CFS-CY |

CY-CFS |

CFS-CFS |

| 1 |

1 |

Single |

Single |

Acceptable |

– |

– |

– |

| 1 |

More than 1 |

Single |

Multiple, but same |

Acceptable (FCL/PART) |

– |

– |

– |

| 1 |

More than 1 |

Single |

Multiple & Different |

– |

– |

Acceptable |

– |

| 1 |

More than 1 |

Multiple & Different |

Multiple & Different |

– |

– |

Acceptable |

– |

| 1 |

1 |

Single |

Single |

Acceptable** |

Acceptable** |

Acceptable** |

Acceptable** |

Important Issues

The following ‘Bill of Lading’ (BL) & Container Combination is unacceptable as one ‘Bill of

Lading’ (BL) contains 2 containers (1 LCL & 1 FCL).

It is not allowed to declare two services (LCL & FCL) in different Service Modes for two

different containers.

Unacceptable:

BL: DAHCGPXXXXXX | Consignee: Company ‘A’ | Container: DAHUXXXXXXX, NLLUXXXXXX (2 Containers)

BL: DAHCGPYYYYYY | Consignee: Company ‘B’ | Container: DAHUXXXXXXX (1 Container only)

Should Be:

BL: DAHCGPXXXXXX | Consignee: Company ‘A’ | Container: NLLUXXXXXX | Service Mode: CY-CY

BL: DAHCGPXXXXXX | Consignee: Company ‘A’ | Container: DAHUXXXXXXX | Service Mode: CY-CFS

BL: DAHCGPYYYYYY | Consignee: Company ‘B’ | Container: DAHUXXXXXXX | Service Mode: CY-CFS

While any manifest amendment is requested by the consignee for the inclusion of the ‘Bill of

Lading’ (BL), no matter if the consignee is the same or not, the Service Mode of all related

‘Bill of Ladings’ (BLs) must be CY-CFS. This is a clear guideline by the ‘Bangladesh Customs

Authority’ and it will not accept any amendment request with the service mode CY-CY

Applicable Rules for Parties in Bill of Lading

| Particulars |

Consignee |

Notify Party |

| Foreign Party |

Unacceptable |

Unacceptable |

| Foreign Bank |

Unacceptable |

Unacceptable |

| Parties without BIN |

Unacceptable |

Unacceptable |

| Local Bank |

Acceptable with ‘To the Order Of’ |

Unacceptable |

| ’To Order’ only |

Unacceptable |

Unacceptable |

| Same as Consignee |

Not Applicable |

Acceptable |

| Bank without Address |

Acceptable with POD permission only |

Not Applicable |

| Bank in Notify Party Column |

Not Applicable |

Unacceptable |

Additional Guideline:

- 'Business Identification Number' (BIN) is not required for Personal Effects

Cargo.

- 'Business Identification Number' (BIN) can be verified from www.nbr.gov.bd.

- The ‘Bangladesh Customs Authority’ prescribes a format for inputting the

'Business Identification Number' (BIN) in the Consignee and Notify Party columns for

specific parties.

- If a shipper provides a 9-digit, 11-digit, or 13-digit 'Business Identification

Number' (BIN) in the specific party column, the ‘Bangladesh Customs Authority’

and the ‘National Board of Revenue, Bangladesh’ (NBR) have instructed to input the

13-digit BIN in the manifest.

Non-License Freight Forwarder

For the Freight Forwarders, 'Agent's Identification Number' (AIN) is mandatory. If any 'Agent's

Identification Number' (AIN) for any Freight Forwarder is found invalid, that specific customer

will be reckoned as a ‘Non-Licensed Freight Forwarder’. If any such cases are found, containers

must be retained on board. Bookings cannot be accepted for non-licensed freight forwarders in

Bangladesh (consignee or notify).

Notes

- In Chittagong Port, Reefer Containers Delivery Mode is only allowed as CY.

-

'Business Identification Number' (BIN) also known as VAT Registration Number is applicable

for Banks and Importers

-

'Agent's Identification Number' (AIN) is applicable for Freight Forwarders.

Free Time Facility for Import under the ‘Chittagong Port Authority’ (CPA)

Free Time Facility for Import Container under the ‘Chittagong Port Authority’ (CPA)

The following table portrays the information about the Free Time for Import Container under the

‘Chittagong Port Authority’ (CPA).

| Particulars |

Beginning of the Storage Time |

Ending of the Storage Time |

Free-Time Period (In Days) |

| FCL/LCL Import |

Container Common Landing Date |

Container Delivery Date (Inside/From Port) |

4 |

| Transshipment Import |

Container Common Landing Date |

Berthing Date of the Export Vessel |

28 |

Notes

-

Free-Time Provision is not applicable for Empty Container

-

Port Demurrage (Store Rent) for Import Laden Container should be settled by the consignee

himself/herself to the respective Port Authority directly as the carriers are not involved

with these charges

Import Cargo Delivery procedure

- Upon the settlement of the payment and surrendering only 1 set of the ‘Original Bill of Lading’

(OBL), the Destination Office/Agent of the carrier will release the Delivery Order to the

consignee.

- For taking the delivery of the Import cargo, if the consignee ensures the presentation of the

‘House Bill of Lading’ (BL) to the carriers, which is duly endorsed by the Bank, and if the

terms of freight is Prepaid, then the carriers have to issue the Delivery Order to the

consignee.

- According to the 'Bangladesh Customs Authority' regulations, receivers are not authorized to

perform Customs Clearance formalities for Import without the presentation of the Original 'Bill

of Lading' (BL) to the 'Bangladesh Customs Authority'. The receiver must obtain clearance from

the 'Bangladesh Customs Authority' through the presentation of the Original 'Bill of Lading'

(BL) to process delivery of import cargo, which further refers that express release procedure is

not acceptable except for shipments of non-commercial cargoes.

- Sometimes, it is seen that the Freight Forwarder or Shipper has not surrendered the ‘Original

Bill of Lading’ (OBL) for any reason, and/or terms of freight reflect as ‘Prepaid’ while the

freight is not settled at the Origin/Port of Loading Office/Agent Office. In that situation, the

Origin/Port of Loading Office/Agent Office of the Carriers advises holding the cargo from

delivery. However, as per local rules, whether the ‘Original Bill of Lading’ (OBL) is

surrendered or not, and whether Freight is actually received or not at the Origin/Port of

Loading Office/Agent Office, if terms of freight are written as 'Freight Prepaid', and the

'House Bill of Lading' (BL) is duly endorsed by the Bank, the carrier cannot hold cargo

delivery.

- If the carriers hold the cargo from delivery to the consignee, then the consignee can directly

approach the Port Authority, and the Port Authority can ensure import cargo delivery without the

presentation of the Delivery Order from the carriers.

Idle Full procedure

If any consignee does not take the delivery of the import cargo within 30 days of storage in the

Port Premises even after due notice from the carriers to consignee/Notify Party, then carriers can

apply to the 'Bangladesh Customs Authority' to treat the cargo as Abandoned Cargo and can request to

sale the cargo by Auction.

The Auction Sale procedure in Bangladesh is very tough and lengthy procedure since there is no

specific rules and regulations for Abandoned Cargo and Auctioning of the Abandoned Cargo is fully

under the control of the 'Bangladesh Customs Authority'. Here the carriers do not have any scope to

arrange the sales of the any Abandoned Cargo through Auction. Moreover, there is no chance to

recover any Detention and Demurrage dues by the Carrier from the sale proceeds. The scenario is more

critical when the Abandoned Cargo is Reefer Cargo and The Port Authority is gauging to deduct the

Store Rent and 'Plug-In & Monitoring fee which is USD 9.00 Per Day coupled with 15% Value Added Tax

(VAT) from the Carrier.

'Reshipment' or 'Return' the Import cargo from Bangladesh to the Origin Country/Port of Loading

If any Import Cargo has arrived in Bangladesh and the carrier has already manifested and declared

the cargo against the respective Consignee/Notify Party to the Bangladesh Customs Authority

accordingly, then the 'Reshipment' or 'Return' of any Imported Cargo from Bangladesh to the

Origin/Port of Loading is very troublesome, expensive, time consuming, lengthy procedure since there

are a lot of factor involved as well as a lot of permissions are required from the concern

authorities upon the submission of the necessary documents which have to be obtained by the

respective shipper/consignee and through their nominated Customs Clearing and Forwarding Agent. the

Shipper has to instruct the Consignee and the Carrier's Port of Destination Office/Agent Office to

advice cost and formalities for 'Reshipment' or 'Return' to the Origin/Port of Loading.

- Formal letter from the Shipper stating a convincing and satisfactory explanation to the

Bangladesh Customs Authority for non-acceptance/return of the cargo by the consignee in

Bangladesh and requesting the Re-Shipment or Return of the goods.

- Formal letters from the Shipper and the involved concerns stating that all expenses will be

borne by the shipper and no Bangladeshi currency will be involved for Re-Shipment or Return of

the cargo.

- Formal Letter from the Overseas Buyer to the concerns for the cancellation of the order (if

applicable).

- Authorization letter from the Shipper to the concerns asking and requesting the Re-Shipment or

Return of the goods.

- No Objection Certificate (NOC) from the Importer/Consignee in Bangladesh for returning the

cargo.

- No Objection Certificate (NOC) from the 'Letter of Credit' (LC) opening Bank stating clearly

that the Bank has no objection if the cargoes are processed for Re-Shipment or Return to Origin.

- No Objection Certificate (NOC) from the Carrier's Office/Agent Office in Bangladesh.

- No Objection Certificate (NOC) from the 'Bangladesh Bank' (Central Bank) through the 'Letter of

Credit' (LC) opening Bank.